Payments On the Go: Anywhere, Anytime Your Business, Your Terms!

Accept payments online and in-store, manage subscriptions and send money with our omnichannel payments solution. Designed for small and large businesses to grow.

Features

Accept payments online and in-store, manage subscriptions and send money with our omnichannel payments solution. Designed for businesses small and large to grow.

Get Paid Faster

Supporting Mobile POS payments for faster checkout, faster onboarding and faster payment cycles.

Easy to Use API

Get access to Omni's APIs for merchant acquiring, as well as technical support along the way.

Advanced Fraud Protection

With chargeback guarantee regardless of the disputed legitimacy, ensuring that your business is protected.

Data-rich Merchant Portal

Get a consolidated view of your online and offline sales as well as valuable customer insights in one easy-to-use merchant portal.

Where We Can Help

Accept payments online and in-store, manage subscriptions and send money with our omnichannel payments solution. Designed for businesses small and large to grow.

Education

School fees, donations or disbursements

Government & Utility

Accept rates, fees, grants, fines, contributions or any type of subsidy

Charities

Accept cashless donations including QR code payments

Retail

E-Commerce, QR code payments or subscriptions

Professional Services

Bills & disbursements for legal, accounting, medical, trade

Associations

Membership fee, online and QR code payments

Travel & Transportation

Lorem ipsum dummy text

E-Commerce

Lorem ipsum dummy text

Hospitality

Lorem ipsum dummy text

Subscription Services

Lorem ipsum dummy text

Automotive Services

Lorem ipsum dummy text

Utilities

Lorem ipsum dummy text

Fitness and Wellness

Lorem ipsum dummy text

Manufacturing

Lorem ipsum dummy text

Why Choose

Omni Payment Solutions

Integrated Solutions

A unified platform that seamlessly integrates accounting, ERP, and POS solutions for a holistic approach to business management.

Scalability

A unified platform that seamlessly integrates accounting, ERP, and POS solutions for a holistic approach to business management.

User-Friendly Interface

Intuitive interfaces across all our software offerings ensure that you can navigate effortlessly, saving you time and minimizing the learning curve.

Security

Trust in the security of your financial data. OMNI Payment Solutions prioritizes the safety of your information through robust security measures.

WE ACCEPT PAYMENTS FROM

WE ACCEPT PAYMENTS FROM

Pricing

No monthly, annual fees.

Sign up for a trial account and get started for free.

1.89% + 30c

Domestic card transactions

2.99% + 30c

International card transactions

$39 standard chargeback fee

Why Partner With Us

A product of leading digital payments company Novatti Group (ASX:NOV), we connect you to an end-to-end payment ecosystem that includes cross-border payments, card issuing, billing, data analytics and fraud prevention solutions.

Great partnerships at your fingertips

Our range in quality partnerships delivers access to cutting edge payment technology accessible through a range of APIs.

Experience you can trust

We're a one-stop shop of payment experts, with 20 years of global experience creating open architected digital transaction technology solutions.

Flexible and scalable tech

Our comprehensive set of APIs allows you to create a unique, custom-built solution. Payments are processed securely on a Level 1 PCI DSS compliant system.

Your success is our win

We work with you to process your payments faster and are continuously offer new payment partner integrations.

ChinaPayments

A product of leading digital payments company Novatti Group (ASX:NOV), we connect you to an end-to-end payment ecosystem that includes cross-border payments, card issuing, billing, data analytics and fraud prevention solutions.

Chinapayments.com was founded in mid-2017 to provide a better cross-border payment solution service for Chinese citizens to pay local Australian bills in Chinese Yuan (RMB).

We provide payment services to cover Australian e-commerce and trade payments through WeChat Pay, AliPay and UnionPay International.

We enable cross-border payment alternatives directly to local Chinese residents through our platform. We work closely with payment partners and BPAY to empower you to pay BPAY bills in CNY (RMB).

FAQ

It’s easy to sign up – complete the ‘Get in Touch’ form below with your name, email, phone number and business name and we’ll send you a login to our merchant portal. The merchant portal will give you access to our test environment where you can explore our APIs. You can also submit your onboarding application by uploading the relevant documents online. Once you’re approved, you can generate Production credentials and start accepting payments. Your application will be reviewed and approved typically within 24 hours.

Unlike some providers, we have no account set up fees and monthly fees. We like to keep fees simple and transparent, which means you only pay what your customers transact. Our standard fee starts at 1.75% including GST + $0.30 per domestic transaction and 2.9% including GST + $0.30 per international transaction. Chargebacks incur a standard fee of $35. We also provide tailored pricing for businesses with large transaction volumes. Reach out to our friendly Sales team for custom pricing.

No, Omni Payments will settle into your existing bank account – you will simply need to provide and confirm your bank account details.

Yes, we support businesses with a variety of payment options including gateway integration, Pay by Link and virtual terminals. We also have alternate payment methods such as PayPal, Alipay & WeChat Pay.

Our virtual terminal allows businesses to easily accept over-the-phone payments. For face-to-face payments Omni has a range of physical payment terminals to suit your needs. Novatti’s innovative Tap2Pay solution allows businesses to accept face-to-face payments using just your mobile phone or tablet.

Yes, Refer to our Direct Debit Service Agreement for more information.

Yes, customers can manage their own schedules for recurring payments by securely storing the payment card data in our platform to prevent any risk of your customers’ data being exposed.

Our integrations are simple to use and we have clear online documentation: https://api-docs.omnipaymentsolutions.com You can reach us on support@omnipaymentsolutions.com for any ongoing support queries.

Yes. Omni Payment Solutions supports a wide range of alternative payment methods such as PaybyCrypto, QR Code Payments and wallet-based payments. Reach out to our sales@omnipaymentsolutions.com for more information.

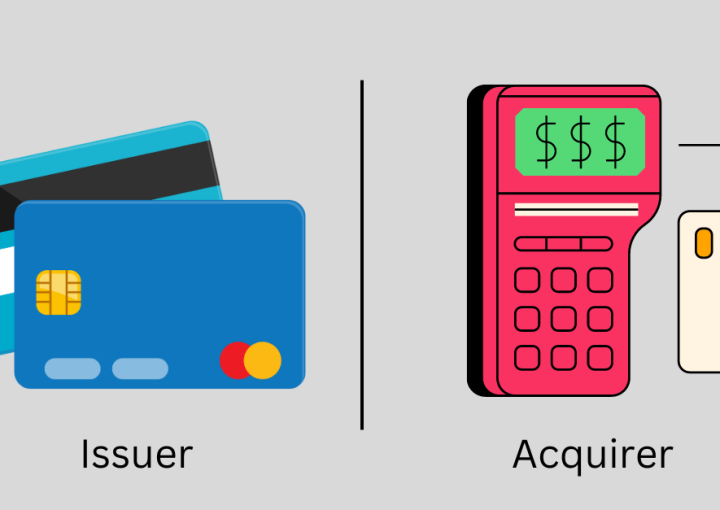

Payment gateways typically require a processor (such as a bank) to fully support card payments online. Omni is different in that it acts as both the payment gateway and processor and can offer a variety of solutions in one. Most gateways will be limited by the capabilities of the processor or bank that they are connected to. By choosing Omni, merchants gain access to numerous additional features and services offered by the wider Omni Group.

Get In Touch

Looking to transform your payment processing and elevate your business? Our dedicated team at OMNI Payment Solutions is here to assist you every step of the way. Whether you're a small start-up or a large enterprise, we have the expertise and solutions to meet your unique payment needs.